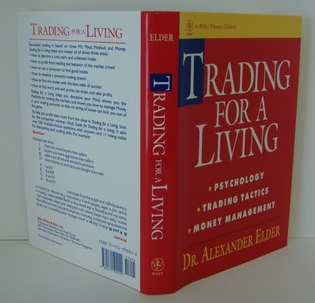

Trading for a Living Successful trading is based on three M’s: Mind, Method, and Money. Trading for a Living helps you master all of those three areas:

- How to become a cool, calm, and collected trader

- How to profit from reading the behavior of the market crowd

- How to use a computer to find good trades

- How to develop a powerful trading system

- How to find the trades with the best odds of success

- How to find entry and exit points, set stops, and take profits

- there are more buyers than sellers

- buyers are more aggressive than sellers

- sellers are afraid and demand a premium

- more shares or contracts are bought than sold

- I and II

- II and III

- II and IV

- III and IV

If somebody bought, read and judged the book by whether it could really help him or her to go "trading for a living", that somebody would definitely be disappointed. Even the author himself pointed out that the success rate for the conversion of ex institutional traders to independent traders was very low owing to the much higher psychological load of trading one's own money than that of trading OPM.

Despite the over-promise of the book title and the second half of it discussing mostly technical tools, the book is quite well written. There are plenty of bright ideas, some with originality that can be attributed to the author's M.D. and psychiatrist background. In particular I like the following points much:-

- That trading is a minus sum game (considering commission and slippage) and the mass media or gurus or prevalent market view are almost always wrong.

- The analogy of the market as an ocean and a huge crowd of people, in either case an individual can have no control of but have to follow (or leave) emotionlessly for long term profit.

- The analogy of Alcoholic Anonymous with Loser Anonymous that requires the same treatment for true recovery, whereas accepting oneself as an alcoholic or a loser is the very first step of healing.

- The need for discipline and patience as individual traders' only weapon to against institutional traders advantages in faster information, better research reports, lower psychological burden for trading OPM, etc

- Price is a psychological event, a momentary balance of opinion between bulls and bears, its pattern reflects the mass psychology of the market.

- Last but not least, the opening prices are determined primarily by amateurs whilst the closing prices are determined by professionals.

In short, the book is well worth the price and I do recommend it to those who study continuously for self improvement in their trading. Remarks:- The author claimed that he personally did so, too.

Get book now >> Trading for a Living: Psychology, Trading Tactics, Money Management

Related Posts